As per the provisions of Section 1233 of the Companies Act 2013 The Board of Directors of a company may declare interim dividend during any financial year out of the surplus in the profit and loss account and out of profits of the financial year in which such interim dividend is sought to be declared Provided that in case the company has incurred loss during. 131 In the present case there is no assertion by the petitioner that the non-declaration of dividends was targeted specifically at the petitioner.

In the CA 2016 the dividend rule is found in s131.

. 205 A in it. Short title and commencement 2. Transfer and Refund Rules 2016.

Substituted vide Companies Amendment Act 2017 dated 03012018 effective from 09022018. Stricter Requirements for Dividend. Short title and commencement-.

1 In this Part an investment company means a public company that. The dividend which includes interim dividend can be paid out of the. The company will remain solvent after each buyback during the period of six months from the date of the declaration in solvency statement.

1 These rules may be called the Companies Declaration and Payment of Dividend Rules 2014. Definition of subsidiary and holding company 5. Prior to omission it read as under.

As per the Companies Act 2013 the term dividend is also inclusive of interim dividend. Companies Commission of Malaysia. 2 They shall come into force on the 1st day of April 2014.

All the unpaid or unclaimed dividend shares which have been transferred to the IEPF shall also be transferred by the company in the name of. The Companies Act 2016. Continue reading Section 123Declaration of dividend.

The Companies Act 71 of 2008 as amended the Act provides a very wide definition of a distribution which goes much further than just cash dividends. Definition of corporation 4. Time Limit for Payment.

1A Subject to subsection 1B any profits of a company applied towards the purchase or acquisition of its own shares in accordance with sections 76B to 76G are not payable as dividends to the shareholders of the company. 1440E dated 29th May 2015. 833 Meaning of investment companyUK.

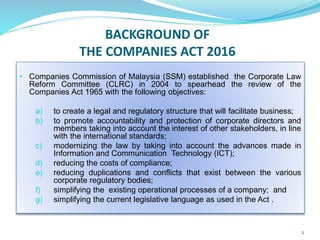

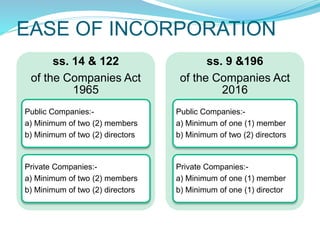

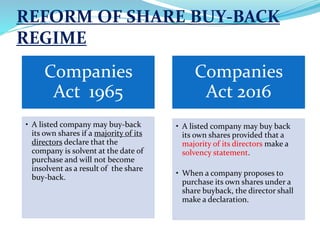

According to law it is mandatory for every company having share capital that makes a profit to declare and distribute a dividend to its shareholders. The Companies Act 2016 CA 2016 repealed the Companies Act 1965 CA 1965 and changed the landscape of company law in Malaysia. 1 No dividend is payable to the shareholders of any company except out of profits.

A has given notice which has not been revoked to the registrar of its intention to carry on business as an investment company and. It has two principles ie 1 the dividend is to be paid out of the companys profits. B section means.

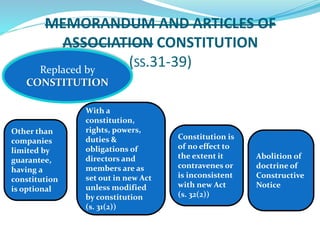

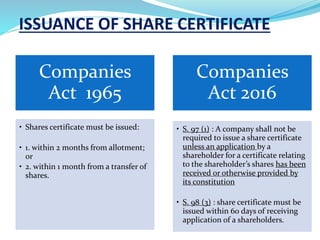

Substituted vide Amendment Notification dated 17112016 applicable from accounting period commencing on or after 01042016. Companies 3 LAWS OF MALAYSIA Act 777 COMPANIES ACT 2016 ARRANGEMENT OF SECTIONS Part I PRELIMINARY Section 1. Whilst the new Act maintains the requirement under the Companies Act 1965 for distribution to.

Punishment for failure to distribute dividend Sec-127 According to the provisions of sec- 127 of the companies act - 2013 if a company fails to pay the dividend within a period of 30 days from the date of its declaration to the shareholders who are entitled to the dividend then-. A Act means the Companies Act 2013. B since the date of that notice has complied with the following F9 requirement.

Rule 35 omitted by the Companies Declaration and Payment of Dividend Second Amendment Rules 2015 vide Notification No. Sections 1122 and 1123 of the new Act. Under Section 205 of the Companies Act 2013 1 contains the regulations for the declaration and distribution of dividend.

Definition of ultimate holding company 6. 1 In these rules unless the context otherwise requires. As per the provisions of Section 1233 of Companies Act 2013 the Board of Directors of a company may declare interim dividend during any financial year out of the surplus in the profit and loss account and out of profits of the financial year in which such interim dividend is sought to be declared Provided that in case the company has incurred loss during.

1 No dividend shall be declared or paid by a company for any financial year except. Inserted by the Companies Amendment Act 2015 vide Notification No. The Companies Amendment Act introduced this provision only in the year 1974 by incorporating Sec.

When a dividend is declared it should be paid within 42 days from the date of declaration. A out of the profits of the company for that year arrived at after providing for depreciation in accordance with the provisions of sub-section 2 or out of the profits of the company for any previous financial. Whist the Companies Act 2016 provides for the distribution of dividends by companies companies at times do not provide dividends much to the chagrin of shareholders.

Of Companies Act 2013 the Dividend which is declared between the 2. And 2 the dividend should not be paid if the payment will cause the. 441E dated 29th May 2015.

Definition of wholly-owned subsidiary 7.

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

Key Changes About The New Companies Act In Malaysia Lo Partnerslo Partners

The Malaysian Companies Act 2016

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

_bill_2016_1510037412_19196-17.jpg)

Company Bill Powerpoint Slides

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016